Manindi Critical Minerals Project, WA (MLS 80%)

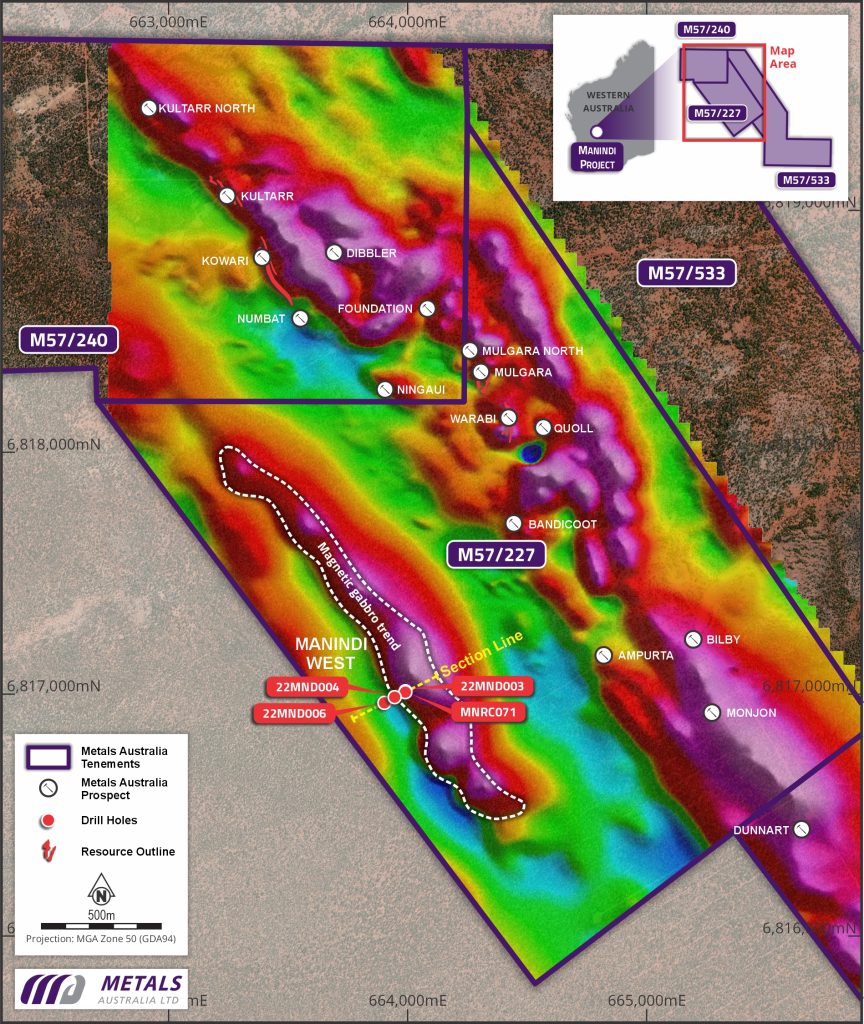

The Manindi Project includes three granted Mining Leases (MLs) situated approximately 20 km southwest of the Youanmi Gold Mine in the Murchison region of Western Australia, approximately 500km northeast of Perth.

- Manindi Vanadium-Titanium-Magnetite Project (VTM): high-grade VTM project in close proximity to the zinc-copper-silver resource outlined below.

- Manindi Zinc-Copper-Silver Resources: high-grade zinc with copper project with existing Mineral Resource – 1.08MT at 6.52% Zn, 0.26% Cu, 3.19 g/t Ag.

Vanadium-Titanium-Magnetite Project (Manindi West VTM Project)

The VTM Project is within a 2 km long magnetic trend which included 3 discovery holes that produced high-grade Titanium-Vanadium-Iron (see Figure 1). Intervals include:

- 58.18m @ 0.36 V2O5, 23.4% TiO2, 28.8% Fe (22MND004)

- 129m @ 0.23% V2O5, 11.5% TiO2, 41.0% Fe (22MND003)

- 70m @ 0.32% V2O5, 12.19% TiO2, 29.3% Fe (MNRC071)

Metallurgical test work was conducted using a composite sample from 22MND004 as representative of the initial drilling.

Metallurgical test work results produced two commercially attractive products (Table 1). Product 1: High-grade Iron-Vanadium Pentoxide product grading 66.0% Fe and 1.19% V2O5 and Product 2: Titanium Oxide-Iron product grading ~ 43.8% TiO2 and 32.0% Fe.

Table 1: Metallurgical test results summary from LIMS & WHGMS processing of 22MND004 core sample

Both products were produced with low levels of impurities. Over 65% of ore sample mass was recovered into the two products (combined product yield). Production of the products was based on simple lab bench tests utilising crush, grind and magnetic separation phases.

Further metallurgical test work is evaluating optimum grain size for recovery and grade for Product 2. This work aims to improve liberation and separation targeting both magnetic and density differences within the material. A target TiO2 grade range of 47-49% is being sought, consistent with higher grade ilmenite contract specifications.

The products have undergone early-stage review for industry end use. Based on positive feedback received so far, no further work is planned for Product 1 (high-grade iron product with Vanadium credits and very low impurities). Product 2 is being further optimised to enhance ilmenite liberation, recovery and thus, TiO2 grade. This type of product has very good end use application – but elevating TiO2 grade can further increase product price premiums. The current price of TiO2>47% is averaging around $280 USD/t. Pricing for 65% Fe fines with no Vanadium credit is ~$122 USD / T CFR basis.

Based on the results from the metallurgical test program, the Company undertook a more extensive drilling program in late 2025. Key highlights include:

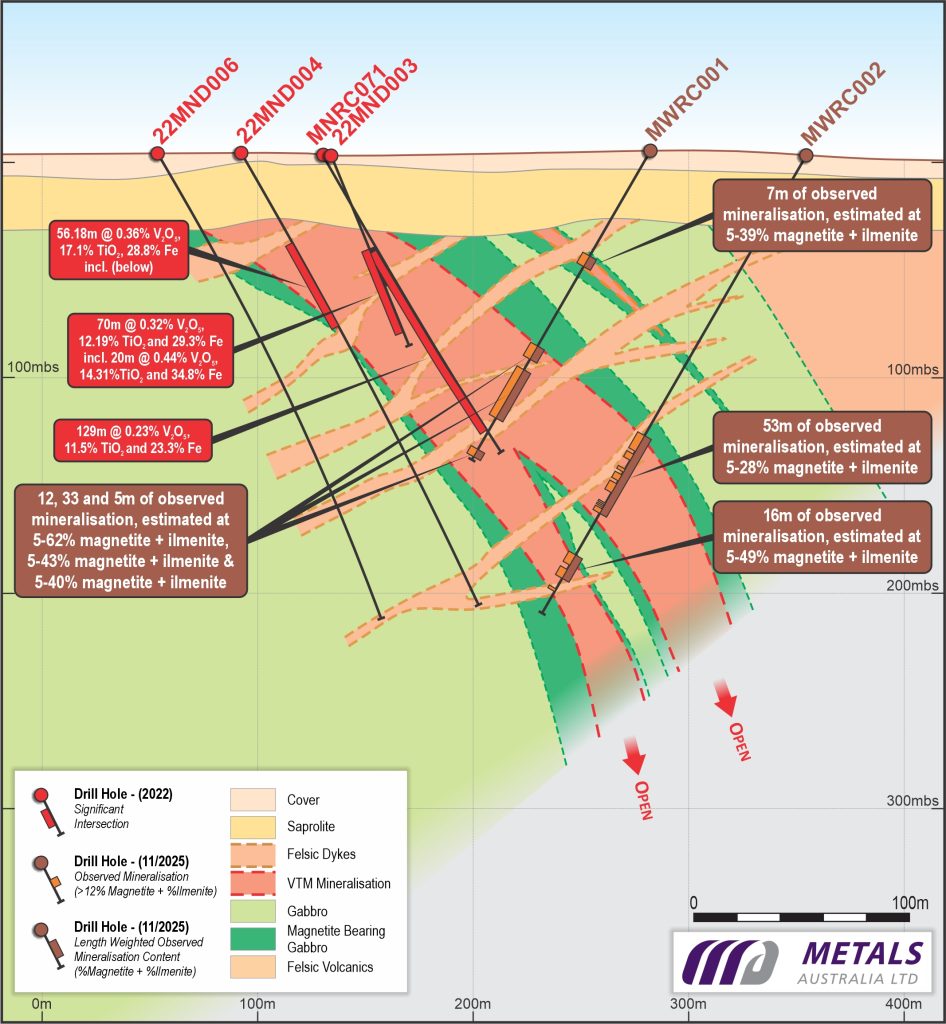

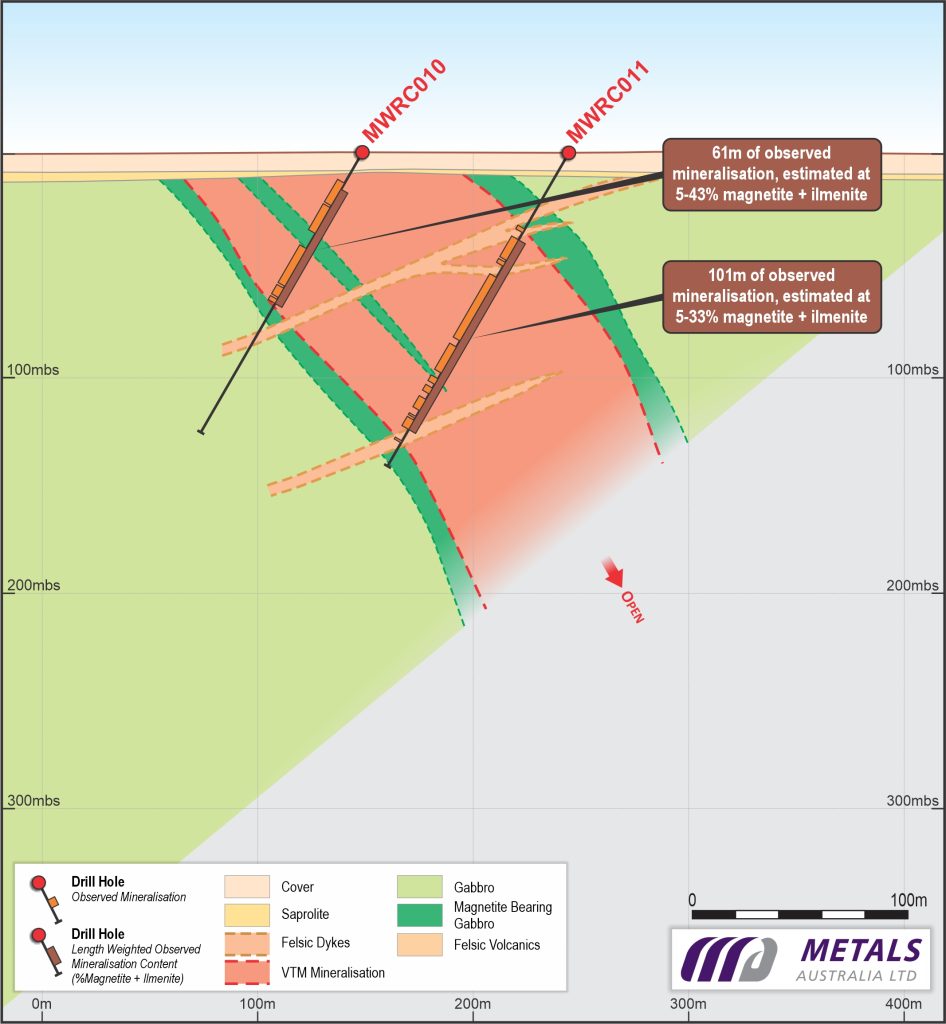

- Drilling consisted of 15 RC holes for 2,774m which included 14 holes in the Discovery Zone. Thirteen of the 14 holes intersected thick intervals of magnetite-ilmenite mineralisation and the mineralisation remains open to the northwest, southeast and at depth (see Figures 3 & 4).

- Drilling confirmed the northwest-southeast extensions of mineralisation over more than 1,000 metres in strike-length. The results also reveal vertical depth of cover to mineralisation ranging at between 16.5m and 52m. The true width of the mineralised zones drilled has been calculated at between 75 and 95m. The vertical extent of the mineralised zone, below the cover, is confirmed to 210m below surface so far. To help demonstrate the key dimensions of the discovery, two cross-sections have been prepared – section A-A’ aligned with the original discovery holes and section B-B’ in the southern extension of the zone. Refer to Figures 3 & 4.

- Based on the success of the program within the Discovery Zone it was decided to test Target 2 which is located over a kilometre to the east within a parallel trend of large and extensive magnetic features (see Figures 2 & 1). A single RC drill hole tested magnetic Target 2 and successfully intersected 61m of mineralised intervals, providing confidence that the additional targets identified (Targets 2 through 52, Refer Figure 1) should also contain similar mineralisation and now warrant further detailed investigation.

Assay results will be used to determine project next steps, which may include:

- Additional drill planning to further define the discovery for conversion to a Mineral Resource.

- More detailed mettalurgical testing using fresh sample obtained, including focus a production of a high purity T1O2

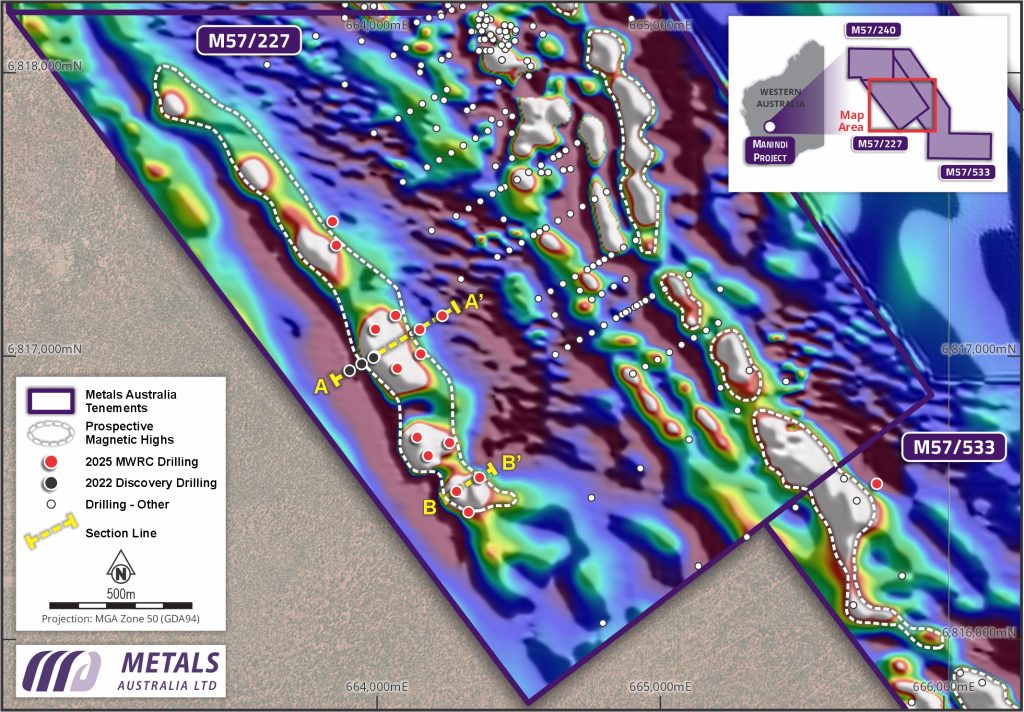

Figure 1: Manindi West Project Map (Magnetic Image – reduced to pole, first vertical derivative), indicates lookalike targets to the discovery zone [Target 1], from a high-resolution magnetic survey

Figure 2: Manindi West VTM Discovery Zone showing new drill hole collars completed (red). A single hole in Target 2 is shown (red).

Section line positions for A-A’ and B-B’ are also shown and are detailed in Figure 3 & 4 below.

|

|

Figure 3: (Section A-A’) & 4 (Sections B-B’): outline geometry of the logged mineralized zones and overall host rock geology. Note the shallow overburden cover at section B-B’.

Manindi Zinc-Copper-Silver Resource

Existing Mineral Resource of 1.08 Mt at 6.52% Zn, 0.26% Cu and 3.19 g/t Ag (including Measured: 37,697 tonnes @ 10.22% Zn, 0.39% Cu, 6.24 g/t Ag; Indicated of 131,472 tonnes @ 7.84% Zn, 0.32% Cu & 4.6 g/t Ag; Inferred: of 906,690 tonnes @ 6.17% Zn, 0.25% Cu & 2.86 g/t Ag).

In late 2024, the company commenced a revaluation of the project, given its proximity to the high-grade Titanium-Vanadium-Iron project and trends in metal prices for zinc, copper and silver. While uncertainty still exists regarding the near-term outlook for zinc, recent price movements have resulted in a significant lift to the mineral value of the resource.

As a result, the company is conducting a comprehensive review of all available information related to the project – including the existing JORC Mineral Resource and potential extensions.

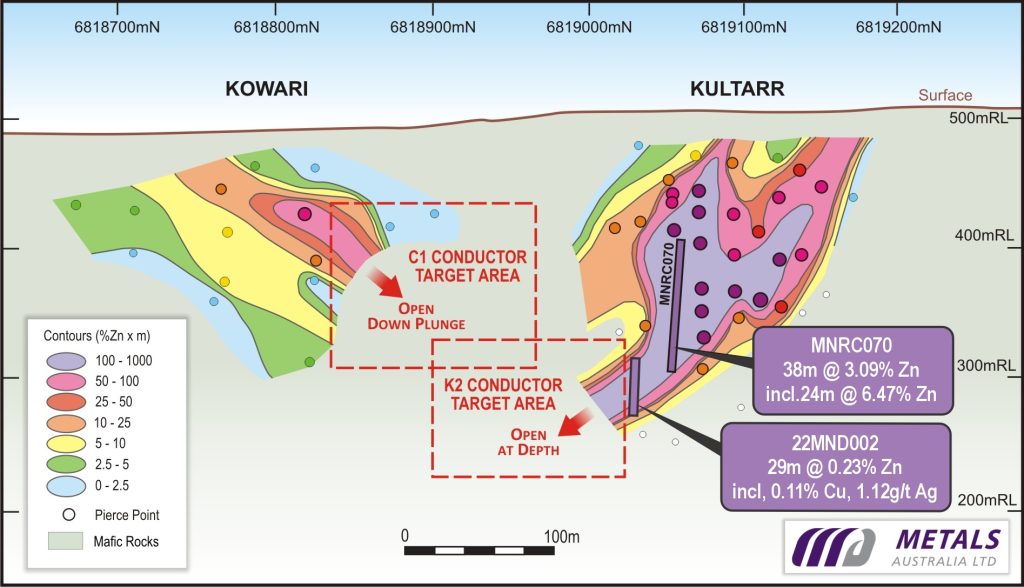

The key aim of the review is to refine resource extension targets that can be drilled to support an increase in the current Mineral Resource. Previously completed and reported down hole electromagnetic work (DHEM) has identified drill targets at depth including those between the known Kultarr and Kowari Resources (Figure 5).

The current Mineral Resource lies within 2 kilometres of the high-grade VTM project outlined in the section below. The ability to grow both projects in parallel also presents an opportunity for a potential combination project, where synergies for potential operations and processing can be further explored in a potential future scoping study. Alternative synergy opportunities within the broader region will also be investigated to determine the best way for value to be created for both the existing Zn-Cu-Ag resource and the high-grade VTM project.

Figure 5: Manindi Project Overview, Regional Magnetics, Resource Locations (red) & VTM Project

Figure 6: Kultarr and Kowari Longitudinal Projection with MNRC070 Intersection