Lac Carheil Graphite Project, Quebec (MLS 100%)

Through its Canadian subsidiary, Northern Resources Inc, the company is advancing the development of the Lac Carheil Graphite Project in Quebec.

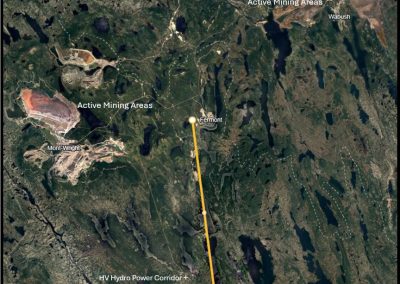

The Lac Carheil Project is located in a major graphite province in eastern Quebec, Canada. The project is well‑accessed and benefits from nearby hydroelectric power, a new highway re‑route linking the area to Fermont, and close rail facilities. The iron‑ore mining town of Fermont is approximately 20 km to the north of the current resource area.

The Company is well progressed on its pathway to develop this critical mineral project in Canada at a time when North American markets are seeking secure long term supplies of domestic graphite.

A world class Mineral Resource containing 5.1 Mt of contained graphite from drilling on just 1 of 10 graphite trends mapped and sampled so far.

Total Mineral Resource: 50 Mt @ 10.2% TGC for 5.1 Mt of contained graphite [Indicated: 24.8 Mt @ 11.3% for 2.8 Mt & Inferred: 25.2 Mt @ 9.1% TGC for 2.3 Mt].

The resource is now 3.3 times larger than the maiden resource it replaced [Prior Indicated & Inferred Resource total of 13.3 Mt @ 11.5% for 1.5 Mt underpinned the 2021 Scoping Study, outlining an initial 14-year project life]

Metallurgical Test Results and Downstream Development:

Extensive metallurgical testwork has returned excellent results, including:

- Flake graphite recoveries of ~96.7% to produce high‑grade concentrate (~95% C(t)).

- Downstream spherical purified graphite (SPG) testwork in Europe produced two high‑value SPG products (SPG18 & SPG10 micron) with overall recovery of ~72% from flake concentrate and purified graphite reaching ~99.99% fixed carbon.

- A preferred location for a Battery Anode Material (BAM) refinery has been identified at Sept‑Îles, Quebec and initial project design and economic work is underway.

Project Study Status & Infrastructure:

- Pre‑Feasibility Study (PFS) work for the concentrate plant and Project Economic Assessment (PEA) work for the BAM refinery are progressing.

- Mine design, environmental and social studies (awarded to Norda Stelo) and infrastructure planning are advancing to support the PFS and subsequent feasibility work.

- Applications have been submitted to Canada’s Critical Minerals Infrastructure Fund (CMIF) for project power and transport infrastructure support.

Precious, Base and Critical Minerals Identified within Graphite Zones:

Including Gallium, Gold, Silver with Copper, Lead, Nickel, Zinc together with iron, vanadium and titanium. Test-work commenced on all graphite zones within initial open cut pit shell.

The Company was recently awarded an R&D Grant from the Quebec Ministry of Natural Resources and Forests, for $600K CAD. The Grant will support the Company’s metallurgical test programs as it progresses from PFS to feasibility level design. This metallurgical test program will commence in early 2026.

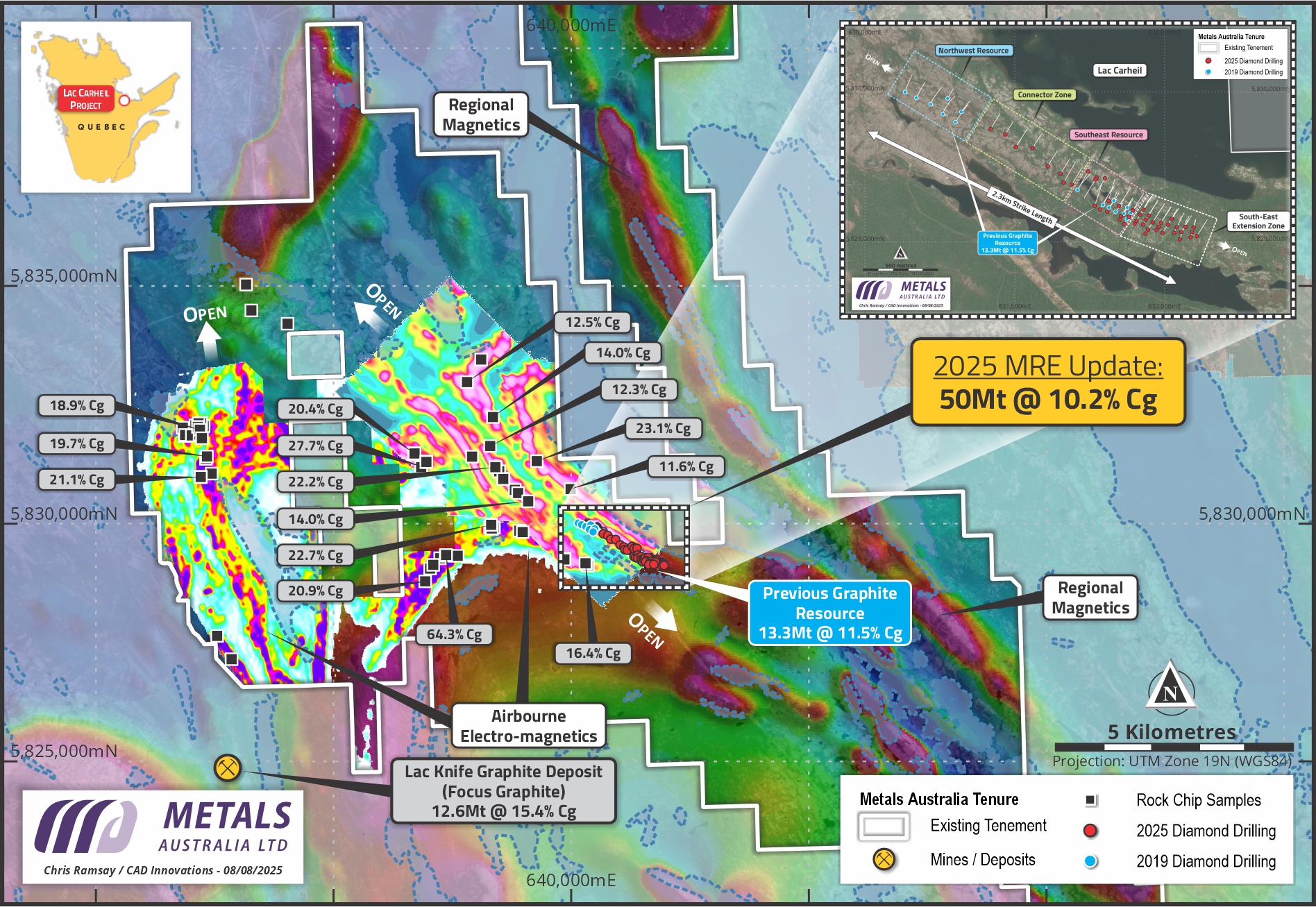

Figure 1: Lac Carheil Graphite Project: New MRE within World class graphite endowment covering 10 mapped and sampled graphite trends over 36km in strike length. Only 1/3 of the claims held have been investigated

Lac Carheil Mineral Resource

Massive Increase in Mineral Resource Reported – Resource modelling and reporting resulted in contained graphite increased 3.3-fold to 5.1 Mt1. 2.3km of the 36 km2 of graphite trends identified have been drilled.

The new Mineral Resource now stands at 50 Mt @ 10.2% TGC for 5.1 Mt of contained graphite [Indicated: 24.8 Mt @ 11.3% for 2.8 Mt & Inferred: 25.2 Mt @ 9.1% TGC for 2.3 Mt]1. The resource is now 3.3 times larger than the maiden resource it replaces [Prior Indicated & Inferred Resource total of 13.3 Mt @ 11.5% for 1.5 Mt3 underpinned the 2021 Scoping Study. Outlining an initial 14-year project life].

The new Mineral Resource model represents information from 64 diamond drill holes (47 from 2025 and 17 from 2019) that include 11,792 meters of NQ drilling (9,482m in 2025 and 2,310m in 2019). Drilling to date has occurred over a strike distance of around 2.3 km on just one of ten identified mapped and sampled graphite trends within the district sized project claims footprint (also expanded over 3 times since the mapping and geophysics program of 2023 used to identify the extent of graphite trends present). Over 36 km of graphite trends have been identified so far. Figure 1 above demonstrates the enormous upside potential for resource additions to the project. This potential can support evaluation for future expansion cases well beyond what is initially envisaged in the PFS. The small, dashed rectangle from which the new resource has been defined is evident in the middle of figure 1, while the graphite trends (pink & purple) and sample locations (black boxes) represent the enormity of what can be drilled in the future. Less than 7% of the graphite trends identified, have now been drilled [just 2.3km of 36 km, or just 6.4%].

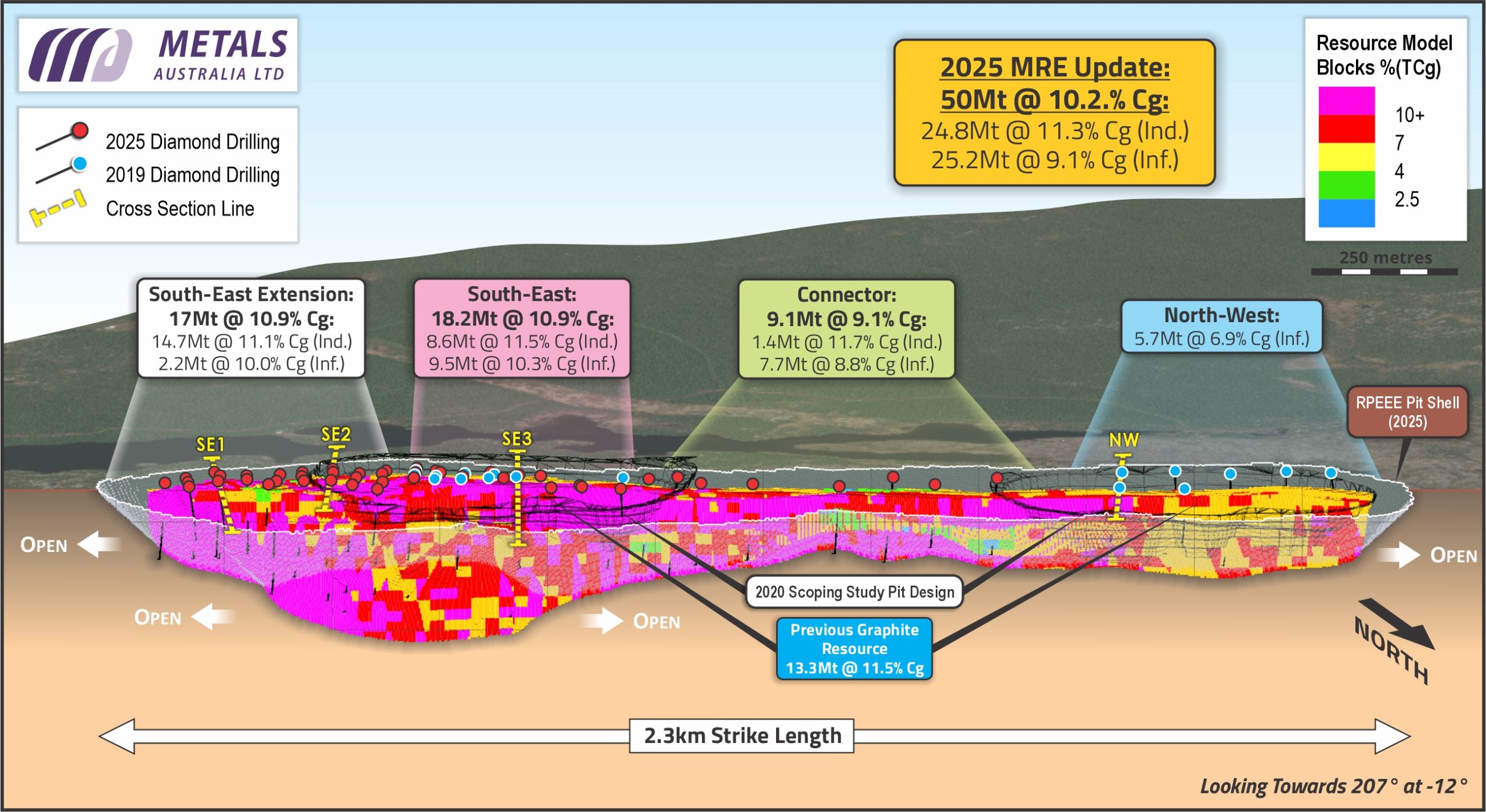

Figure 2 below outlines the new Mineral Resource in section showing the respective zones as well as the indicated and inferred resource.

Figure 2: New MRE Extends ~2.3km in strike length on just one of ten identified graphite trends

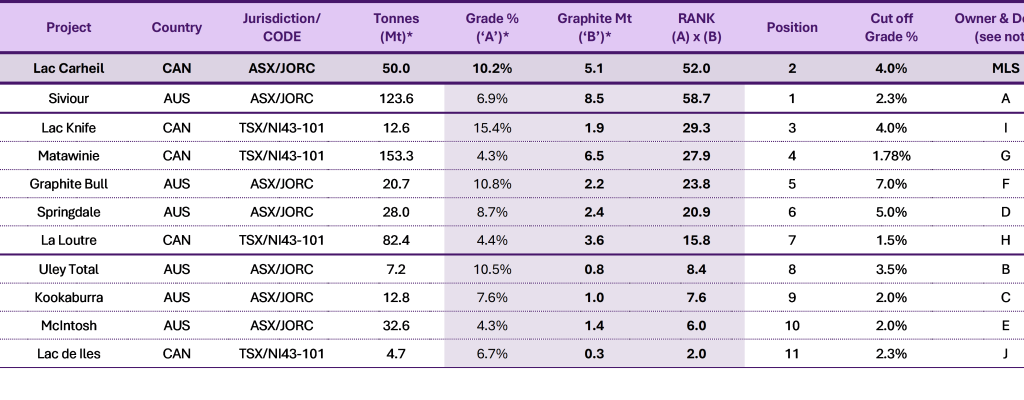

To help demonstrate the significance of the Mineral Resource now reported and its premier location – with ease of access to North American and European markets – a table below summarises projects advancing in similar low sovereign risk jurisdictions (Australia or Canada) with at least a published project economic assessment (Scoping Study). In a limited number of cases, the project referenced may also have declared an Ore Reserve – which DRA Americas (as appointed mining consultant) is now well advanced in preparing for the Lac Carheil project as part of the PFS study. For comparable analysis now, projects are assessed based on the totality of their declared Mineral Resource (i.e. Measured, Indicated and Inferred). Refer to table 1 & relevant references (A to K) listed in the Metals Australia September 2025 Quarterly Activities Report.

Table 1 provides a summary of the project name, country, total mineral resource, graphite grade and the total contained graphite tonnage reported in resource. A ranking measure assesses the resource grade and the total graphite tonnage contained. This measure [a product of grade and contained tonnes] demonstrates that Lac Carheil is a top ranked project (#2). Only two projects listed currently have more contained graphite reported. Lac Carheil has the potential to grow significantly, given less than 7% of mapped and sampled trends have been drilled so far.

Table 1: Publicly listed Company Projects in Tier 1 jurisdictions of Australia and Canada with a minimum of a Scoping Study published. Projects rank on the product of grade and contained graphite tonnes

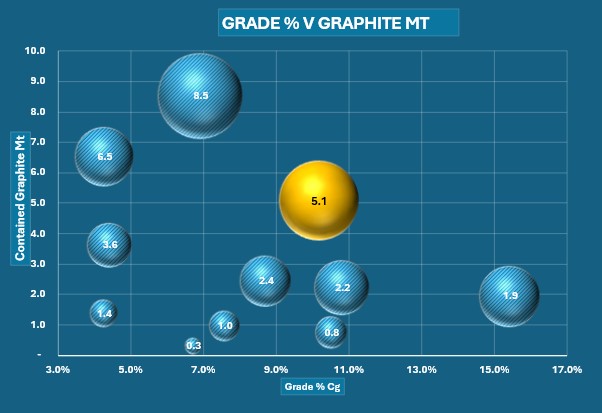

Information from the table above has also been respresented graphically below in Figure 3. This figure demonstrates that the only project that has a graphite grade greater than 9% and contained graphite tonnes above 4 million tonnes is the Lac Carheil project as indicated in the yellow bubble below.

Figure 3: Projects mapped by graphite grade (TGC%) and Contained Graphite Mt. Bubble size is Graphite grade (number) times contained graphite tonnes. Lac Carheil in Gold

Metallurgical Testwork

The testwork resulted in excellent improvements in Flake Graphite Recovery which have now been taken into the PFS design.

Test work has now confirmed graphite recovery of 96.7% (at concentrate grade of 95.4% C(t)) has been achieved. This is a significant improvement compared to the graphite recovery used in the 2021 scoping study [86.3%]. The increase [absolute +10.4% or incremental improvement of 12.1%] will result in significant improvements – with more graphite concentrate recovered per tonne of graphitic mineralisation processed. The benefit of this improvement includes lower mining tonnage (waste removal and feed tonnes to the plant) per tonne of concentrate produced. The improvements will be reflected in the new mine plan, production schedule and cost projections.

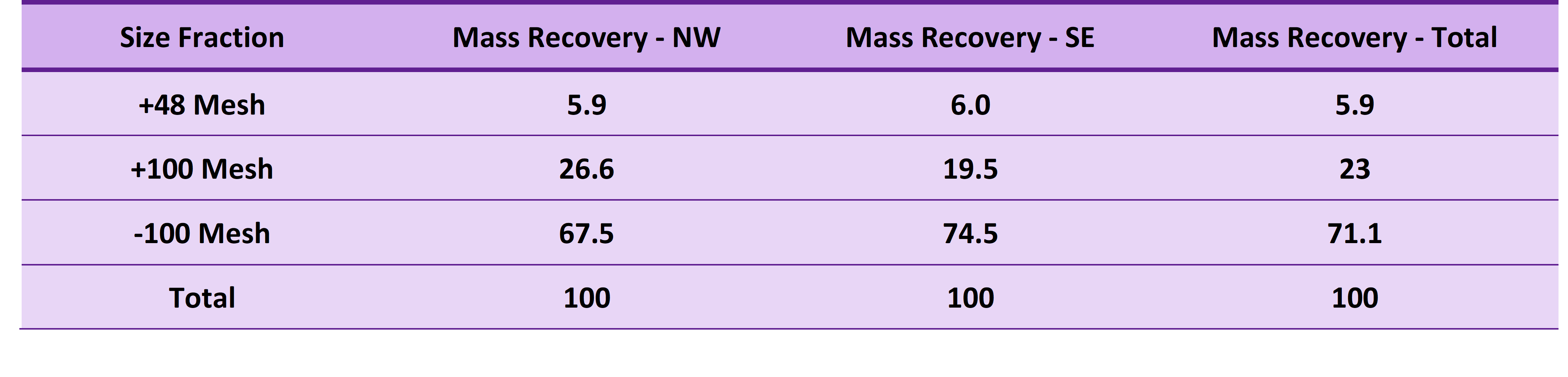

The metallurgical test work also validated parameters for concentrate products which in turn influence design parameters for the downstream Battery Anode Material Plant design. Test work has demonstrated that the concentrate from the SE zone separates at ~ 25% into coarse and medium flake graphite concentrate products. The balance, ~75%, is finer flake concentrate that will become feedstock for Battery Anode Material upgrading. The SE and SE extensions zones of the mineral resource represent most of the mineral resource classified at indicated level (Figure 2). The indicated resources will be reviewed for Ore Reserve assessment, so these zones represent the initial mining areas for the project. Table 2 outlines the concentrate size fractions planned to be produced in the Flake graphite concentrate plant and the relative mass recovery applicable to key mining zones. The SE zone test work is most applicable for the current PFS and PEA study work.

Table 2: Mass Recovery by size distribution for samples from Northwest and Southeast resource zones (original)

Downstream Development

Excellent progress is being made by Dorfner Anzaplan at their laboratory in Germany and engineering design offices in the UK. Dorfner Anzaplan and their associates are completing metallurgical test work for conversion of flake graphite concentrate into Battery Anode Material (BAM) products.

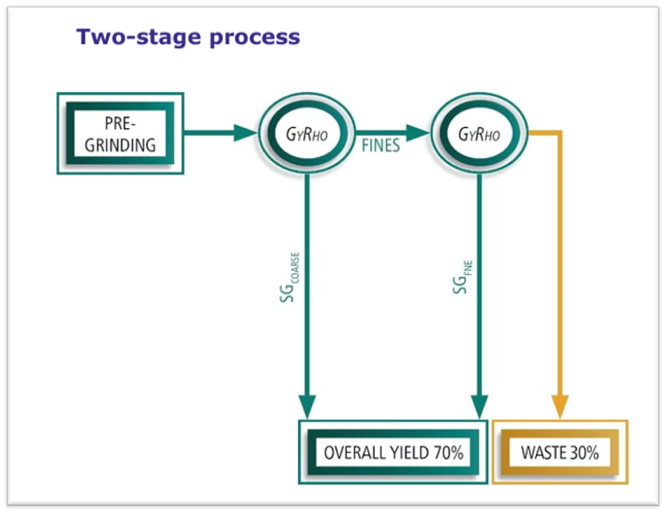

The results of initial metallurgical test work aimed at determining milling, shaping and purification of flake graphite into spherical purified graphite (SPG) have been completed. The milling, shaping and purification test work resulted in the production of two SPG products (SPG 18 and SPG 10 micron) with an overall conversion (recovery) of flake graphite concentrate at 72%. This exceptionally high result was based on a two-stage milling and shaping process. The byproduct produced is a super fine micronized product that also has use in industrial applications – including the steel industry, effectively resulting in no wasted graphite in the process (Refer to Figure 4).

Despite the very high conversion rate (recovery), further opportunities exist to tailor the concentrate feed and the milling and shaping processes to enhance the overall recovery of concentrate to SPG product. This will be further evaluated in future phases of test work that are currently being planned.

In addition to the very high conversion of flake graphite concentrate into SPG product, a preferred purification process has been established (Hydro fluoric acid free process) which resulted in purified SG achieving 99.99% Fixed Carbon content (FC%). This result comfortably exceeded the 99.95% FC target required for production of Battery Anode material. Furthermore, the SPG 18-micron product achieved excellent tap density of up to 0.99 g / cm3 – above the target of 0.95 g / cm3.

The parameters above are all now being used in the PEA for design basis of the Battery Anode Material Plant. Next steps in the test program are already underway, including coating the SPG (producing CSPG) and testing its electrochemical performance in battery applications. Two test paths are being evaluated in parallel, with performance to be compared to standards used in industry. Coating is being conducted both by Anzaplan at their laboratories in Hirschau, Germany in addition to CSPG that has been sent to Xinde New Material – a leading producer and supplier of coating materials to the battery manufacturing industry. The deep expertise of Xinde and Chinese production of Battery Anode Material will provide an excellent comparator set of test results for battery performance of Lac Carheil CSPG product.

A simplified diagram outlining the two-step milling and shaping process undertaken by Anzaplan in conjunction with their associates is provided in Figure 4 below, together with recovery results achieved that are being used in the design of the Battery Anode Material Plant

Figure 4: Schematic depicting milling and spheroidisation of products – SG18 & SG10. The “Fines” stream is a super fine, micronized carbon product with application in a wide range of metallurgical industry uses.

With key metallurgical assumptions settled for design, the design team from Anzaplan’s UK subsidiary, Dorfner Anzaplan UK Ltd, based in Norwich, are now advancing the technical and economic assessment for the Battery Anode facility. As noted, initial designs will focus on the upgrading of the -100-mesh concentrate from the upstream facility. The Battery Anode Material plant will be designed based on 3 parallel production trains, each of 25 KTPA processing capacity. The combined process would result in up to 75 KTPA of processing per year, generating up to 54 KTPA of battery anode material products (SPG 18, SPG 10) and 21 KTPA of Super fines for alternate industrial markets.

Project Study Status and Infrastructure

Mining & Environmental studies underway to complete PFS – DRA Americas have commenced study work for the mine design and infrastructure components of the PFS study. The work scopes include all aspects of mine design and open pit optimisation – including optimised extraction sequence of the resource and preparation of the maiden mineral reserve statement, which will be published together with the PFS.

Mining design scope will include haul roads, stockpile and overburden disposal requirements – including dry stack deposition of tailings from the process plant. Trade-offs between owner operator mining versus contract mining will also be assessed as part of the study.

Additional scopes covered under the award include mine infrastructure to compliment the process and non-process related infrastructure – (other than mining) covered by Lycopodium. This includes design of Mine Maintenance Facility, Mine Changeroom – including crib room, fuel station and explosive storage facility. DRA will also complete a concentrate transportation assessment – which include transportation options to key port facilities along the St Lawrence River (including Sept-Iles).

Norda Stelo – a Quebec City based (since 1963) engineering and environmental consulting firm has been awarded the mandate to identify the main environmental and social risks, determine the required permits and authorizations, and define the scope of environmental studies associated with the construction and operation of the Lac Carheil graphite project for the PFS.

In addition to completing the necessary environmental reviews, Norda Stelo is also leading the geochemistry component of the study, specifically assessing the characteristics of waste rock, ore and tailings material to inform design recommendations.

Norda Stelo will also develop a comprehensive road map outlining all regulatory and permitting requirements for the project, including timelines and budget forecasts to support future regulatory submissions. Transfert Environnment et société (Transfert)’s role has been expanded to include the social engagement elements of the PFS project.

Battery Anode Material Plant Location Selected as Sept-Îles, Quebec for detailed evaluation

The company has provisionally selected Sept-Îles in Quebec (Seven Islands in French) as its preferred location for a Battery Anode Material Facility. Post quarter end, wide ranging meetings have been held in Sept-Îles with local government, infrastructure service providers and other key stakeholder groups. Excellent progress is being made in the following areas of the study:

- Transport Logistics: Rail of proposed concentrate from Labrador city to suitable industrial zone.

- Preferred Industrial Zone: Review of available industrial zones with preferred location identified for detailed analysis.

- Port Access: Industrial land includes easy access to port facilities amenable for container freight transfers, including ferry access available to connect to the Canadian National Railway (CN Rail) for accessibility to north American markets.

Sept-Îles

Sept-Îles is a city in the Côte-Nord region of Quebec. The city provides port facilities to the Iron ore mines in the north of the province, or to the immediate neighbouring province of Newfoundland and Labrador. It is situated on the St Lawrence River, with the deepest water port in Quebec. Shipping to the west provides access to Montreal or through the great lakes to USA markets. To the east, the markets of Europe are readily accessible, via the Atlantic Ocean. Sept-Îles – as one of the oldest settled regions in Quebec – is home to the first peoples of the land, now represented by the Innu first nations band government known as Innu Takuaikan Uashat Mak Mani-Utenam (or ITUM). The city has a regional population of approximately 24,500 and a large airport for ease of access.

Precious, Base and Critical Minerals Identified

Additional test work was undertaken on selected holes within the resource that were being assessed for geotechnical and geochemical study purposes. The multi element results revealed widespread mineralisation within the graphite zones. The significance of this finding is that the minerals present will all be mined with the graphite, further concentrated in process plant and (currently) deposited in dry tailings stockpiles. Further work is now underway to more broadly test all graphite zones within the SE and SE extension zones of the mineral resource, given they will form the basis of the initial planned open cut mine.

Test work is also being planned to investigate the extent to which the minerals identified can be further concentrated and economically recovered, in addition to the graphite. A key benefit of being able to achieve a positive outcome would be a potential reduction in high sulphide tailings material that would need to be disposed of at site. This assessment will be conducted during the next phase of metallurgical test work, which is supported by the Quebec Ministry of Natural Resources PARIDM grant.

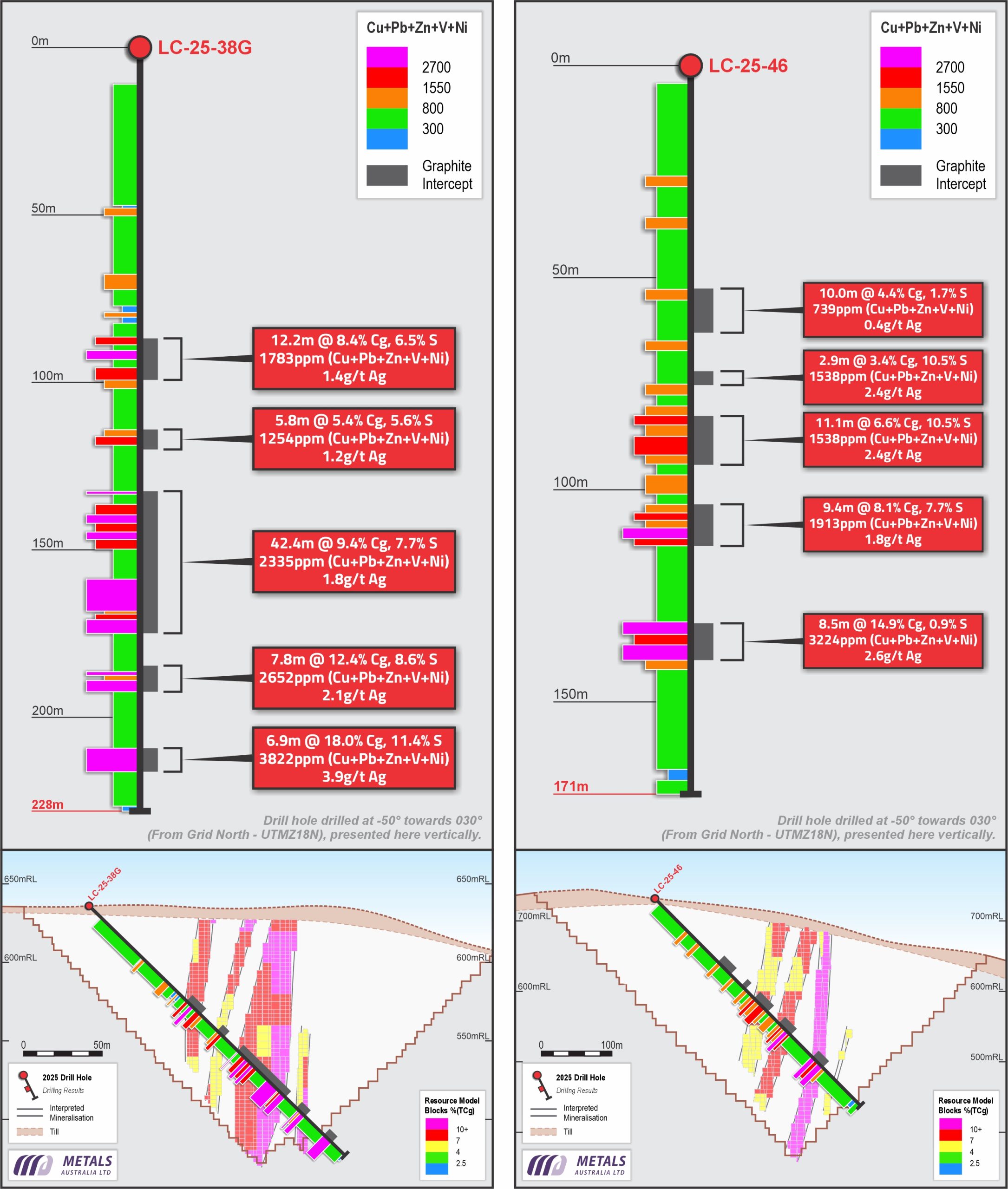

Key findings to date include full multi element assessment from two holes:

Holes LC-25-38G and LC-25-46 were tested at >1m intervals with the following results: Ref. Figs. 1 & 5-6

- LC-25-38G (Southeast zone) included: Gallium (Ga) up to 16.5g/t (33 intervals > 10 g/t), Silver (Ag) up to 5.5 g/t (32 intervals of silver above 1 g/t), Copper (Cu) up to 552ppm (30 intervals > 200ppm), Iron (Fe) up to 23.2%, Vanadium (V) up to 1,760ppm (23 intervals >500ppm), Zinc (Zn) to 2,840 ppm (19 intervals >1,000ppm). Nickel (Ni) up to 365ppm is also present. Ref Fig 1&5

- LC-25-46 (Connector zone): Gallium up to 14.7 g/t (27 intervals > 10 g/t), Silver up to 3.14 g/t (19 intervals > 1g/t), Copper up to 463ppm (18 intervals >200ppm), Iron up to 18.9%, Vanadium up to 1,345ppm (7 intervals >500ppm) & Zinc to 2,010 ppm (6 intervals >1,000ppm). Ref Fig 1&6

The two holes above have also been depicted in down hole log form. The Figures below show the graphitic carbon intervals and the strong correlation with precious, base and critical mineral levels, which have been added together (other than silver) for ease of reference.

Figure 5: LC-25-38G (Southeastern zone) & Fig 6: LC-25-38G (Connector zone): Figures show downhole log of graphite zones and related mineralisation ((Cu + Pb + Zn + V + Ni Combined basis) & Silver – g/t) and Cross Section of each hole shown beneath the log. Hole collar positions are also shown in Fig 1.

Mining Research and Innovation (PARIDM) Grant

Metals Australia’s wholly owned Canadian subsidiary, Northern Resources Inc. (NR Inc.), has been awarded a PARIDM grant – specifically aimed at supporting projects progressing research and innovation as part of their progress towards development. The program will assist the company as it progresses future metallurgical design phases for the Flake graphite concentrate plant – from PFS level flow sheet design to Bankable Feasibility Level.

The award includes a contribution of up to $600 K CAD (approximately $660 K AUD) to cover work outlined in the grant application. The contribution can cover up to 40% of total applicable costs.

A program of work has been planned in conjunction with MetPro Management and SGS R&D. A large representative sample of the new resource will be prepared once the mining plan has been completed. This bulk sample will be used to conduct more detailed investigation work aimed at firming up the flow sheet to bankable feasibility study level.

The grant funding does not preclude additional funding being sourced, including further grants, to offset all or some of the portion of costs that NR Inc. would contribute as the program advances.

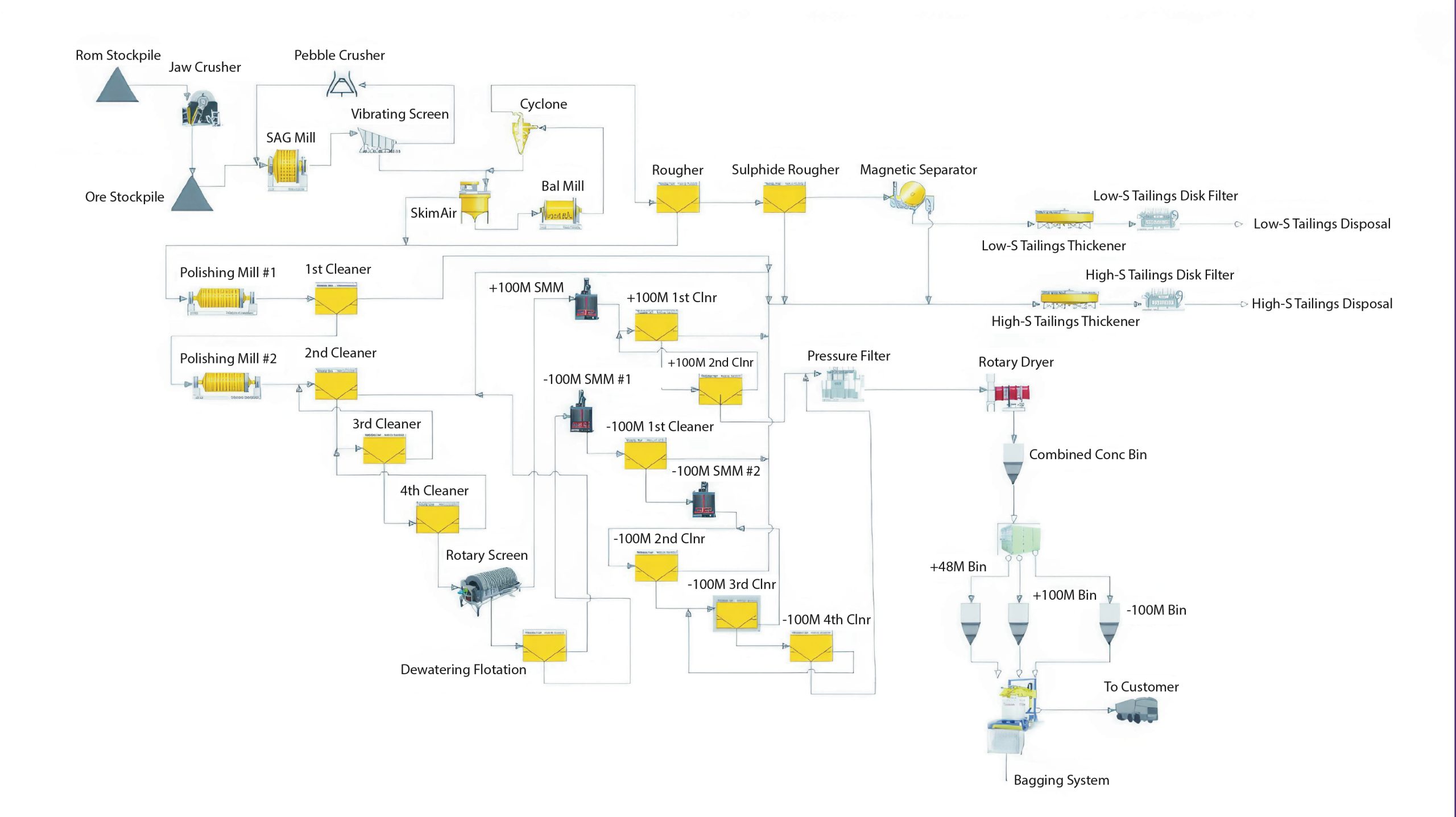

The current PFS level flow sheet, which has been developed from laboratory scale metallurgical testing at SGS’s Lakefield laboratory in Ontario, is set out in Figure 7. The program has been overseen by MetPro Management – a metallurgical consultancy with significant experience in the design and development of natural flake graphite projects.

Figure 7: Lac Carheil Graphite Project – PFS Process Flowsheet for Flake Graphite Concentrate Plant designed to produce 100,000 tonnes per annum of > 95% Total Graphitic Carbon (TGC).

Key aspects of the PFS flow sheet design include a feed system comprising crushing, initial milling, followed by SkimAir flotation, rougher flotation, sulphide flotation – with tailings processed via Magnetic Separation, thickening, filtering and disposal stockpiles. Graphite is progressed through successive steps involving polishing mills and cleaning stages – initially to scalp off + 100 Mesh (0.149 mm) screening, followed by dewatering (screen undersize only), separate stirred media milling and cleaner flotation of the screen oversize and undersize fractions. The combined concentrate is filtered and then dried prior to entering the bulk concentrate feed bin which feeds the screening and product bagging plant. Key products will be coarse Flake (+48 Mesh), Medium Flake (+100 Mesh) and Fine (-100 Mesh).

The current test-work has resulted in a flow sheet design that has been optimised, at laboratory scale, for Lac Carheil flake graphite. In addition to optimising size recovery for flake graphite, the flow sheet also features a design to produce a relatively dry, inert tailings waste product that can be co-disposed with run of mine waste rock from the mining operation. The benefit of this approach is to ensure that potential acid generative material, from high sulphide waste products, is removed during the process. This approach substantially reduces environmental impacts related to long term waste storage – as well as eliminating the need for a conventional Tailings Storage Facility (TSF). This would be a significant point of difference for the operation, when compared to mining operations in proximity to Lac Carheil – as well as being a key criterion considered during the review of our grant application from a sustainability perspective (environmental, economic and social).

The further work planned between PFS and Bankable Feasibility Study (FS) – utilising a fresh, representative sample from the revised and potentially upgraded Mineral Resource, will enable additional pilot scale test work on key pieces of processing equipment which is aimed at improving confidence in the design. This additional step will also enhance confidence by potential offtake parties and investors who will conduct due diligence on the rigour of the design proposed to be taken into construction.

Quebec Minister of Natural Resources and Forests and the Minister responsible for the Bas-SaintLaurent and Gaspésie−Îles-de-la-Madeleine regions, Maïté Blanchette Vézina

“In a complex geopolitical context and strong global demand for minerals, it is becoming more strategic than ever to support companies that want to optimize their practices with a view to sustainable development. Innovation and the development of our great mineral potential are essential keys to ensuring the sustainable future of our mining sector, maintaining our competitiveness on the international scene and decarbonizing the economy.” Projects funded through PARIDM, such as [Northern Resources Inc.’s] Lac Carheil project contribute to the socioeconomic development of Quebec and its regions.”

[Translated from French to English]

Quebec Minister of Employment, Minister responsible for the Côte-Nord region and MNAs for Duplessis

Kateri Champagne Jourdain

“The benefits of this project and [Northern Resources] activities could significantly stimulate the Côte-Nord economy and ultimately make it a major hub for graphite extraction and concentration in Quebec. Our mineral resources and innovation in this field are a powerful driver of regional development. I applaud this initiative by the company and wish it every success.”

[Translated from French to English]